The Provider Planning Difference

Provider Planning is an independent financial & business consulting firm specializing in working with growth-oriented, entrepreneurial, white coat professionals who are committed to growing their practices and Net Worth.

We are certainly not financial advisors in the traditional sense of the word. We are not investment advisors. We do not believe in the traditional financial planning strategies of Accumulation and Depletion of paper assets managed by Wall Street.

We are the opposite of financial planners. We are

Financial Freedom Consultants™ with a belief that you need to invest in yourself first to grow income, invest in & grow your business to make it self-managing, freeing you from having to trade time for money, invest in real estate for your business as well as for passive income, and become debt-free all before investing in anything you can’t control.

We know that you and your business are a better bet than Wall Street. And we show you how to create growth projections with an

Action Plan to scale your business, grow your income, trade it for passive income, and gain freedom of time, money, and energy.

We free your mind from “the matrix” of financial indoctrination that is plaguing Americans and failing Americans, especially our healthcare providers who are often preyed upon by the financial industry. We show you

The Way of the Contrarian. If there is an Elite 1%, that means that they are doing the opposite of what the other 99% are doing. We open your eyes to financial engine that your practice can be for you in a way that puts you in control.

We accomplish this by creating your

10 Year Plan in your

Financial Freedom Day.

What We Do Different

Independent, Unbiased, Fee-Only Advice

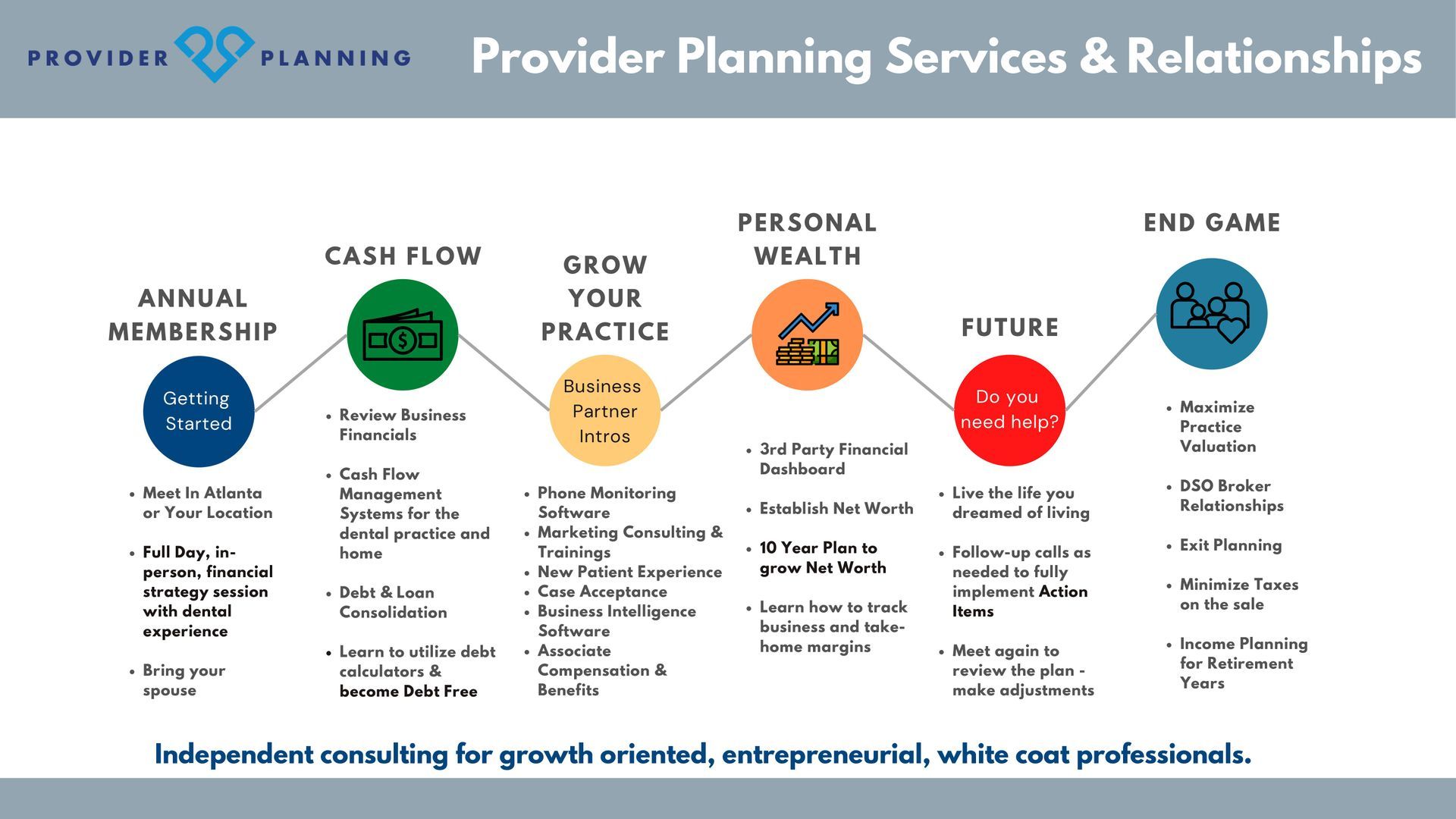

We charge a flat annual Planning Membership fee in order to serve truthful advice to clients, deliver clear Action Items to be implemented, and provide ongoing accountability coaching throughout the year. We make ourselves available on this membership retainer to work through financial projects or questions that may arise.

We do not manage investments. We leave that to the investment advisors so that we do not have any conflict of interest in our advice. In-fact, there are some cases where it might make sense to liquidate investments to pay off debt because that is genuinely the best move. We want to be able to show clients that without hesitancy and being compensated on a flat fee promotes that.

We do offer independent insurance brokerage services, but without any requirement to utilize them. We want to be able to educate clients on what they have, how it works, and everything else that is available in the marketplace. There are cases where it makes sense to alter, purchase more, or drop coverages. Our Planning Membership fee allows us to give the advice freely, and clients can take it back to their own agents, or they may choose to utilize our insurance brokerage service.

We operate independently, so we aren’t going to sell you

products you don’t need. Our objectivity enables us to provide unbiased financial advice.

Net Worth Focused

When it comes to building wealth, you might find that the typical financial advisor is only most concerned about your investment account, its performance, and your savings rate into it. However, an investment account is not the sole contributing element to your Net Worth.

There is one financial topic that typically gets neglected, and that’s

Debt Reduction. Most advisors ignore their client’s debt because they don’t get paid to focus on it. Paying down debt is one of the smartest financial moves anyone can make, and it is a key ingredient to growing your Net Worth.

If you are a business owner, your business is an income-producing asset with a value that should be included in your Net Worth statement because it can potentially be sold one day. It’s also likely the asset that you have the most control over and provides the greatest return on investment. Your business is likely a better bet than Wall Street. That’s why we are heavily focused on the business performance and how it contributes to your Net Worth.

Integrated Financial Tracking

We use the latest in web-based technology to provide you with an online X-Ray of all of your finances in one place. We build a custom Financial Dashboard for you that tracks all of your changes in assets & liabilities, ultimately tracking your Net Worth progress.

You can link your online accounts and view the balance changes real-time on a daily basis, as well as securely store any important financial documents in an encrypted online vault.

With access to your Dashboard from any smartphone, tablet or computer, anywhere, anytime, you will always be organized and prepared to make moves. It takes the pain away from filling out a

Personal Financial Statement each time you apply for a loan, and banks love it!

Custom Advice

We specialize in helping growth-oriented white coat business owners. This includes, but is not limited to, dentists, veterinarians, plastic surgeons, dermatologists, optometrists, ophthalmologists, podiatrists and chiropractors.

We don’t give generic, cookie-cutter advice or trainings. We custom-design your future planning & forecasting to your business, to your personal and professional goals, and we keep you aware of how you compare to your industry peers in similar circumstances.

Our unique client experience involves an entire day totally dedicated to you, your family, and your business. We call this your

Financial Freedom Day where we lay out the next 10 years of your business & personal financial life in your custom

10 Year Plan. Then, we are at your service for the remainder of the year as you need us to implement!

Location

790 Peachtree Industrial Blvd. Suite 100, Suwanee GA, 30024

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed